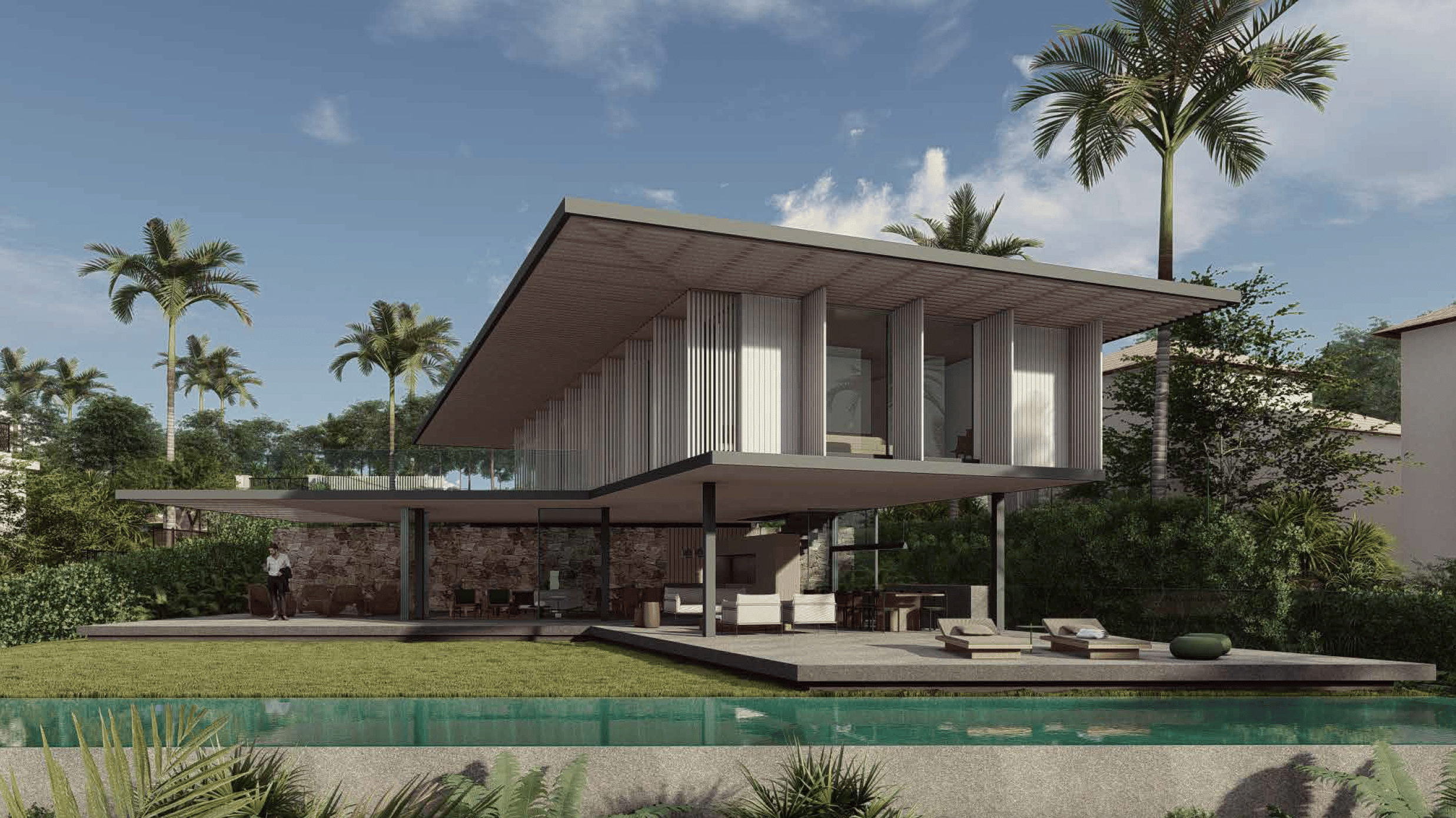

Design-led properties.

elevated experience.

Lamar Development brings the latest global design aesthetics to unexpected places, working with category-defining architects and designers including Patricia Urquiola, Studio MK27, Jacobsen Arquitetura, Isay Weinfeld & David Chipperfield.

Featured projects

Lamar Development brings top scale property projects to completion, harnessing value by tuning the assets to their target market in order to maximize yield.

Press releases

From exclusive property launches to luxury developments, stay up-to-date with the latest media coverage of Lamar in the high-end property market.

See all press releases